Does Marketing Still Believe in Brand Growth?

If brand growth is no longer possible, then the current focus on cost reduction makes sense. But if brand growth is possible, then cost reduction is the wrong strategy.

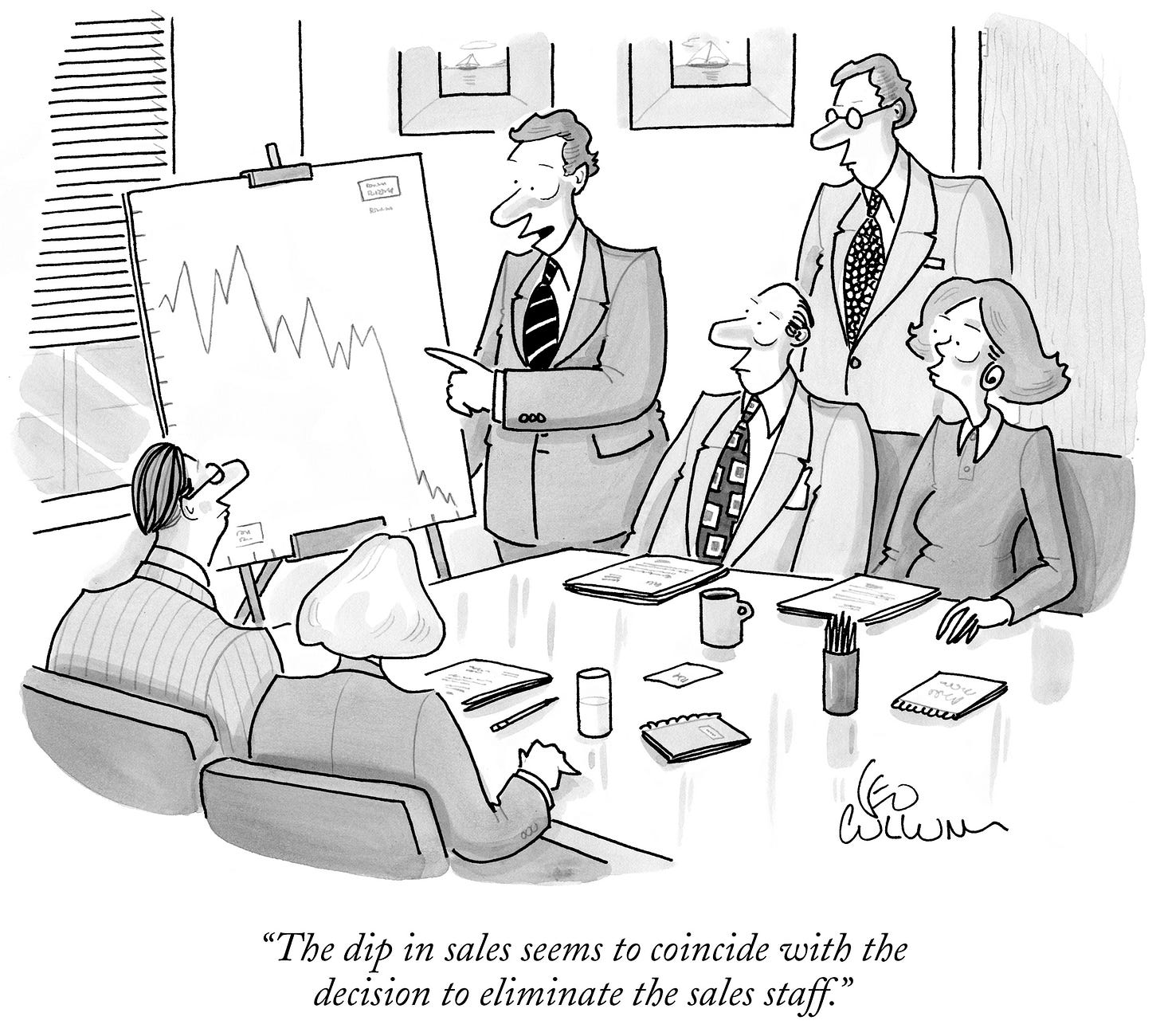

Credit: Leo Cullum, The New Yorker, The Cartoon Bank

The list of major advertisers with low organic sales growth since 2009 is a long one: Bank of America, Best Buy, Colgate, eBay, Gap, GSK, Honda, IBM, Kohl's, Kraft Heinz, Macy's, Burger King, Nestle, Novartis, P&G, Pfizer, Sanofi, Sony, Unilever, Verizon, Wells Fargo….and many others.

Granted, the 16 years since 2009 has been long and complex. Digital / social advertising entered the industry and now dominates media spend. TV waned in importance, and the Generation Z that came of age during this period was little exposed to the type of advertising that helped to build “big brands.”

We should not be surprised that Gen Z consumers have different brand preferences from their parents.

Furthermore, private label competition for the big, advertised brands has grown relentlessly, and private label products have taken much of the underlying growth in many product categories, operating under the strong brand reputations of their retailers (Walmart, Target, Costco, Kroger’s, Albertsons, Publix, etc.), whose own-brand offerings can be as much as 30% below the branded prices.

Legacy brands have taken a beating, and despite Marketing’s efforts to “personalize” advertising to consumers, the effort has not succeeded in raising legacy brand growth rates.

Instead, what we’ve seen are Marketing initiatives to lower costs across the board:

Shifting media to low-cost CPMs;

Buying lower-cost media via principal-based trading;

Cutting fees to media and creative agencies, despite their SOW workload increases;

Investing in in-house agencies;

Cutting direct deals with Google and Meta;

Exploiting AI as a further initiative to lower media costs.

Line extensions have largely replaced new product development in many legacy brand categories. One example is breakfast cereals, a declining brand category (2.1 million tons in 2008 to 1.6 million tons in 2023):

Cheerios, once positioned as a “heart-healthy” brand, now offers over 20 line extensions that include heavily sweetened varieties (frosted, chocolate, fruit-flavored, etc.).

Special K, once a diet-focused cereal, has over 20 flavored line extensions, including bars, shakes and snacks.

This may be great for the maintenance of shelf space, but it is not growing the category or the brands.

CMOs have short tenures at their companies, let go principally because of their inability to deliver growth — CEOs and CFOs still believe in the need for brand growth to maintain share price growth.

Although companies with nearly flat sales growth see share prices grow by 5% annually, those with higher sales growth rates — say, sales growing at 5% per year — see share prices grow by over 15% per year.

There is share price growth leverage from sales increases.

But has Marketing given up this battle? Have legacy brands achieved their “full growth potential” in the face of private label competition and changing consumer tastes / preferences?

I don’t know the answer to this question, but long experience in consulting has taught me that all businesses and all brands underperform their full potential. There’s always something that can be done to create additional growth — if you look hard and imaginatively at the possibilities and do the required brand strategic analyses.

I’ve observed the following in Marketing:

Media and creative scopes of work for legacy brands are not designed to solve brand growth problems. They’re designed to continue the trend towards buying lower-cost media.

Brand strategic plans are not designed to outline where growth can be achieved through innovative initiatives. Instead, they’re designed to “sell” to the C-Suite the wisdom and success of current initiatives.

Too many Media Mix Modeling (MMM) diagnoses are not designed to change the spend levels and mix of media SOWs. Instead, like brand strategic plans, they’re used to communicate to the C-Suite the wisdom and success of current Marketing initiatives.

In short, Marketing is often more engaged in justifying its current activities, using whatever metrics do the trick, rather than finding innovative ways of changing activities in order to achieve improved brand performance.

Conservativism and risk aversion rule. Marketing seeks certainty rather than the rewards from risk-taking.

There’s certainty in cost reduction, of course — wider margins and stagnant brand growth.

Marketing needs to identify the full performance potential of its existing brands and get back into the risk-taking business again. That’s the only way that breakthrough growth performance can once again be achieved.

This is a great paradigm and really get's at the heart of the logic. To grow a brand entails cost, do not expect brand growth if you are reducing cost.

Yes, there will be risk, yes there are no guarantees, yes measuring is difficult, but you should not expect brand growth if you are reducing cost.

"Marketing seeks certainty rather than the rewards from risk-taking."

Feels pervasive. If you're an outside consultant (or agency) do you think there's any easy answer to the fact that growth is always going to feel like risk (and it often is).