Madison Avenue Media Madness

The wholesale embrace of personalized advertising enriches the tech platforms and fails to grow client brands. Marketing Mix Modeling is needed to evaluate "what really works" for advertisers.

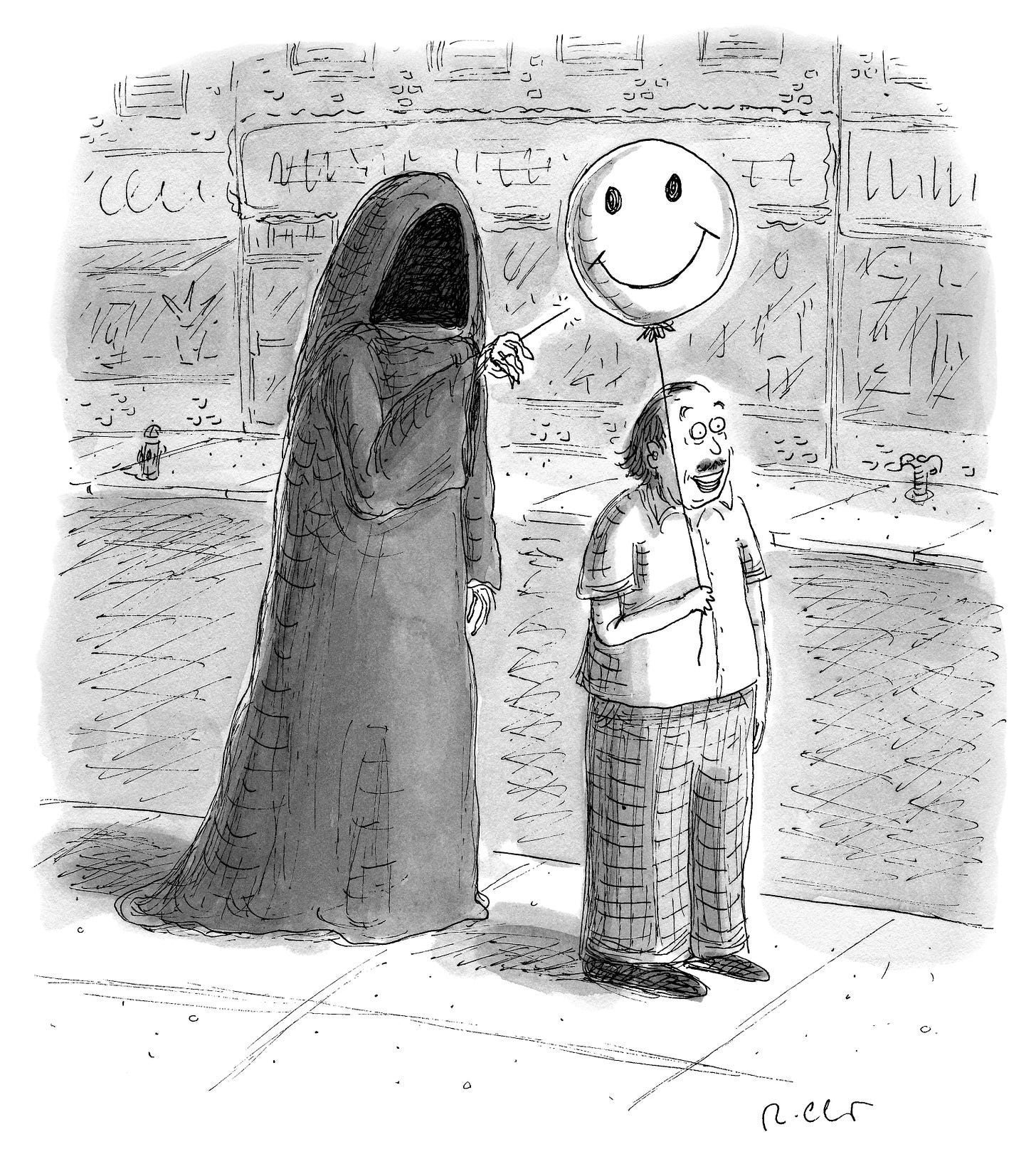

Credit: Roz Chast, The New Yorker, The Cartoon Bank

Consider the following: for the fifty years from 1960 to 2010, the combined FMCG sales of P&G, Unilever, Nestle and Colgate-Palmolive grew at about an 8% compounded annual growth rate per year.

The numbers associated with this long-term growth rate are staggering. P&G alone grew from about $1 billion (1960) to $79 billion in 2010. Throughout this period, P&G was the industry’s advocate for the power of advertising, becoming the largest advertiser in the US, with a focus on traditional advertising — digital / social advertising had hardly begun until 2010.

Since 2010, with the advent of digital / social advertising, and massive increases in digital / social spend, P&G, Unilever, Nestle and Colgate-Palmolive have grown, collectively, at less than 1% per year, about half the growth rate of the US economy (2.1% per year).

They are not the only major advertisers who have grown below GDP rates. At least 20 of the 50 largest advertisers in the US have grown below 2% per year for the past 15 years.

Digital and social advertising, of course, have come to dominate the advertising scene since 2010, and it represents, today, about 2/3rds of all advertising spend.

Most major advertisers today say something like the following to Wall Street and the trade:

“We have strategically leveraged digital and social media platforms to enhance our marketing effectiveness and drive sales growth.”

“We have implemented agile global platforms to streamline our vast digital marketing presence, reducing costs, accelerating time to market, and enhancing customer experiences.”

They rely on no one checking their sales figures. Legacy advertisers have not grown their brands.

Look for yourself on Macrotrends (https://www.macrotrends.net) if you wish to check sales figures for publicly-owned major advertisers. The results are positively depressing.

Massive Increase in Digital / Social Ecosystem Structure, Players and Costs

The post-2010 shift to digital / social advertising was accompanied by a massive increase in infrastructure and its alphabet soup of acronyms.

DSPs (demand-side platforms) are used by advertisers or agencies to buy digital ad inventory automatically. The Trade Desk, Google Display & Video 360, MediaMath, Amazon Advertising, Xandr, Adobe Advertising Cloud, Criteo, Magnite, Amobee and Quantcast are well-known players.

SSPs (supply-side platforms) are used by publishers to manage, sell and optimize their ad inventories. Magnite, Google Ad Manager, PubMatic, OpenX, Index Exchange, Sovrn, AppNexus, RubiX, TripleLift and Smaato are major players.

The infrastructure siphons off enough of the client media spend so that, according to ANA, “just 36 cents of every dollar effectively reaches the end consumer, with the rest swallowed by a ‘cost waterfall.’ Ad-tech transaction costs eat up 29% of that spend, while 35% is wasted on unmeasurable or low-value environments like made for advertising (MFA) sites.”

In addition, advertisers and their agencies pay suppliers for metrics about digital / social users who might become brand customers:

MQL (marketing qualified leads) who have a “high level of interest” in brands compared to the average. HubSpot, Marketo, Pardot, ActiveCampaign, Eloqua, LeadSquared, Drift, Infusionsoft, SharpSpring and LeadsBridge are among the MQL providers.

SQL (sales qualified leads), who are expected to convert into paying customers. HubSpot, Salesforce, Marketo and others provide SQLs.

Other metrics, like LCR (lead conversion rate), CAC (customer acquisition cost), LTV (customer lifetime value), Sales Pipeline Velocity, Opportunity-to-Win Ratio, Sales Funnel Metrics and Engagement Score are pored over by marketing analysts at ad agencies and advertisers alike.

Excessive Complexity

Needless to say, the complexity and cost of the digital / social system has created a major challenge for marketing and its agencies. The past 15 years have been marked by “we have to figure out how it works and exploit it for our brands!”

Lost in the process is the answer to a simple question: “Does it actually work?”

Media executive Nick Manning, looking back at his 40+ years as a media agency founder, media agency CEO and Ebiquity executive smiles ironically when you mention “personalized advertising” to him.

“Personalized advertising is as annoying as having a well-meaning charity person stop you on the street when you’re busy running errands.

“You are not really interested in what he or she has to say, even if you support their cause.

“You resent the intrusion.

“And if the charity doubled the number of volunteers on the sidewalks, it would only double your annoyance rather than double the donations you give.”

What’s to be done?

Advertisers and their agencies need to declare victory — they’ve mastered the complexities of digital / social advertising, and now they know how it works. They’ve had 15 years to do this. They have spent massive amounts of money on digital / social specialists in their organizations, on digital / social media, on the digital / social infrastructure and on its metrics.

Unfortunately, the ROI as measured in sales growth has been poor if non-existent. In addition, the poor sales growth has led to high CMO turnover, increased procurement power, reductions in agency fees, growth in unproductive scopes of work, downsizing of senior agency executives and acceleration of agency relationship turnovers.

This is not a positive overall outcome.

The industry has suffered — except, of course, for Google, Meta, Amazon, the DSPs, the SSPs and the many other providers of media services and metrics.

Media Mix Modeling (MMM)

The time has come for marketing to revisit its spend levels and the mix of services it pays for.

Not surprising, new MMM developers, like Mutinex , are rising to the challenge, permitting CMOs to evaluate their entire portfolio of marketing initiatives, including (in addition to spend and mix) the effect of pricing, distribution, creative quality and other factors.

“What actually works?” is the question CMOs should be asking, and Mutinex’s AI-powered front-end permits CMOs to ask plain-English questions — along with radical questions like “what would be the effect if we eliminated all of our programmatic advertising?”

Media Mix Modeling ought to become the CMO’s best tool in 2025. Forget about all the suppliers touting the latest developments in customer targeting. You’ve been there and done that, and it hasn’t created enough value for your brands.

Marketers need to move in new directions in 2025 and challenge the status quo.

Media Mix Modeling is the tool for this next phase of marketing operations.

I appreciate that the visuals with your posts do not feel AI generated!

Agree with the high dependency of digital (CPM)..but it would be interesting if you can take a look this https://www.linkedin.com/posts/christofleuenberger_food-beverage-execution-activity-7302122690386022400-my9m?utm_source=share&utm_medium=member_ios&rcm=ACoAAAVBz7gB0c8Q99VAoXQ4bmZacKjkzoMNsco