Making Sense of Four Holding Companies: WPP, Omnicom, IPG and Publicis (Corrected)

During the past 8 years, IPG and Publicis have grown their revenues, while WPP and Omnicom have declined. These holding companies are not managed in a uniform way. What's going on?

Credit: Al Ross, The New Yorker, The Cartoon Bank

WPP, led for 33 years by Sir Martin Sorrell (from 1985 to 2018), established what became the “business as usual” approach for holding company operations:

Acquire agencies and other marketing service operations across a range of disciplines to establish a pattern of growth.

Separate media operations from creative operations.

Establish tough budget targets to drive agency cost reductions and margin improvements.

Grow Holding Company share price. Incentivize C-Suite Executives by linking their remuneration to “making the numbers.”

Then, after the introduction of digital and social advertising (after 2004):

Pitch “Holding Company” relationships to clients — offer a “full range of traditional / digital / social services” involving holding company agencies.

New Business Approach. Mobilize C-Suite Executives for new business wins. Price low without worrying too much about scope of work (SOW) workloads. Accept whatever you win. Scale agency resources to fees (rather than to workloads) in order to make required margins.

Continue to require annual agency downsizings to grow margins in the face of procurement-led fee reductions.

Engage in principal media buying to make up for the declining profitability of the base media and creative businesses.

Performance: 2016 to 2023 (8 years)

How have WPP, Omnicom, IPG and Publicis performed from 2016 to 2023? How important is the “business as usual” framework for growth?

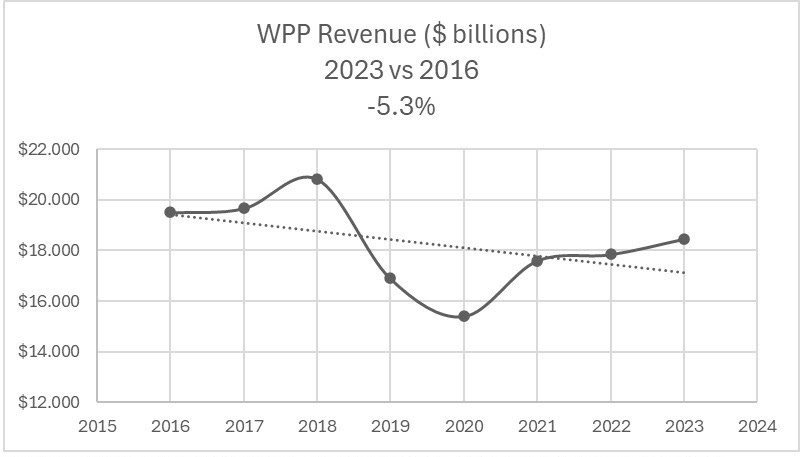

WPP

Mark Read took over WPP after Sorrell departed in 2018. Read had a tough first year, dealing not only with the contentious nature of Sorrell’s departure but also with the loss of long-term clients Ford, American Express and PepsiCo. Sales and earnings were under enormous pressure.

Instead of acquiring more companies, which was impossible under the circumstances, Read turned his attention internally, merging VML + Y&R, and Wunderman + JWT in 2018. (In 2024, he doubled down by merging all of these operations into a single VML operation).

In addition, he put WPP’s data analytics business, Kantar, up for sale.

Otherwise, it was “business as usual” at WPP with no program of acquisitions. The basic media and creative businesses suffered, as they did for the entire industry, as a result of scope of work increases and client fee reductions. Downsizings had the effect of liquidating agency talent in senior and mid-level positions.

Between 2016 and 2023, WPP employment headcounts dropped from 134,341 to 114,732 (-14.6%). Sales declined from $19.5 billion to $18.5 billion (-5.3%). Note that the employment reduction was much more severe than the sales reduction — downsizing has always been a go-to strategy for WPP.

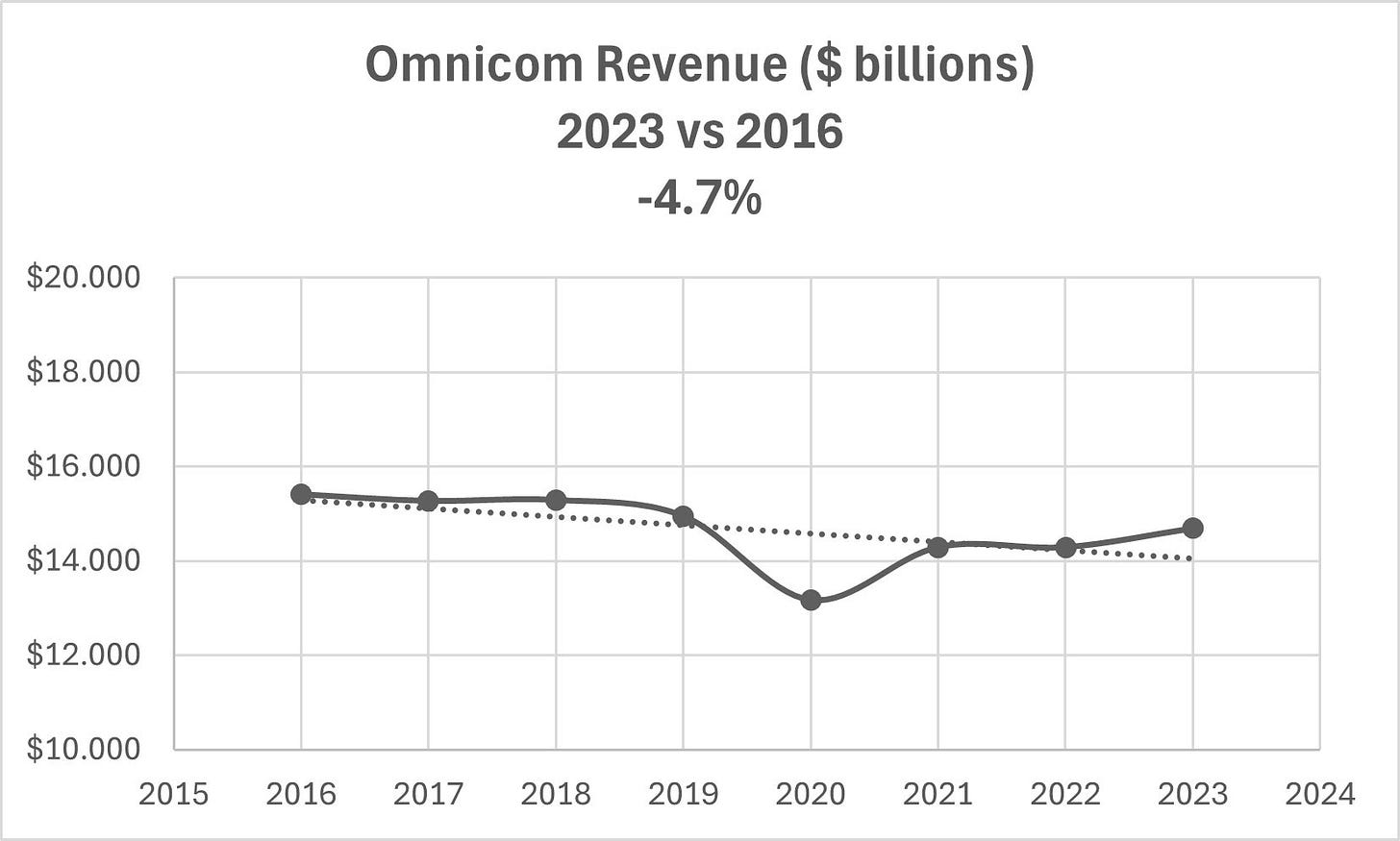

Omnicom. Omnicom has not been a major acquirer of operations, and thus far it has not merged any of its major agencies. (Its 2024 creation of Omnicom Advertising Group under a new C-Suite team drawn from TBWA’s leadership team may hint at its future priorities).

Omnicom has operated as a conservative “business as usual” holding company, deriving its performance from its existing portfolio of agencies. Scope of work increases and fee reductions have adversely affected its financial performance. Over the past 15 years, it has grown its revenue at only 1.6% per year, well below 2.1% GDP growth.

From 2016 to 2023, its employment headcount dropped from 78,500 to 75,900 (-3.3%), and sales declined from $15.4 billion to $14.7 billion (-4.7%).

Omnicom’s flat performance may be a clear indication of the “state of the industry” — its media and creative operations do not grow, despite Omnicom’s efforts to promote its award-winning creativity.

Creativity, for all of its other benefits, has not driven sales growth at Omnicom.

That said, Omnicom has generally enjoyed a higher Price / Earnings (P/E) ratio than its competitors, so there is always the possibility that its promotion of “creativity” has had a positive effect on Wall Street, enhancing its stock price (and the compensation levels of its C-Suite Executives).

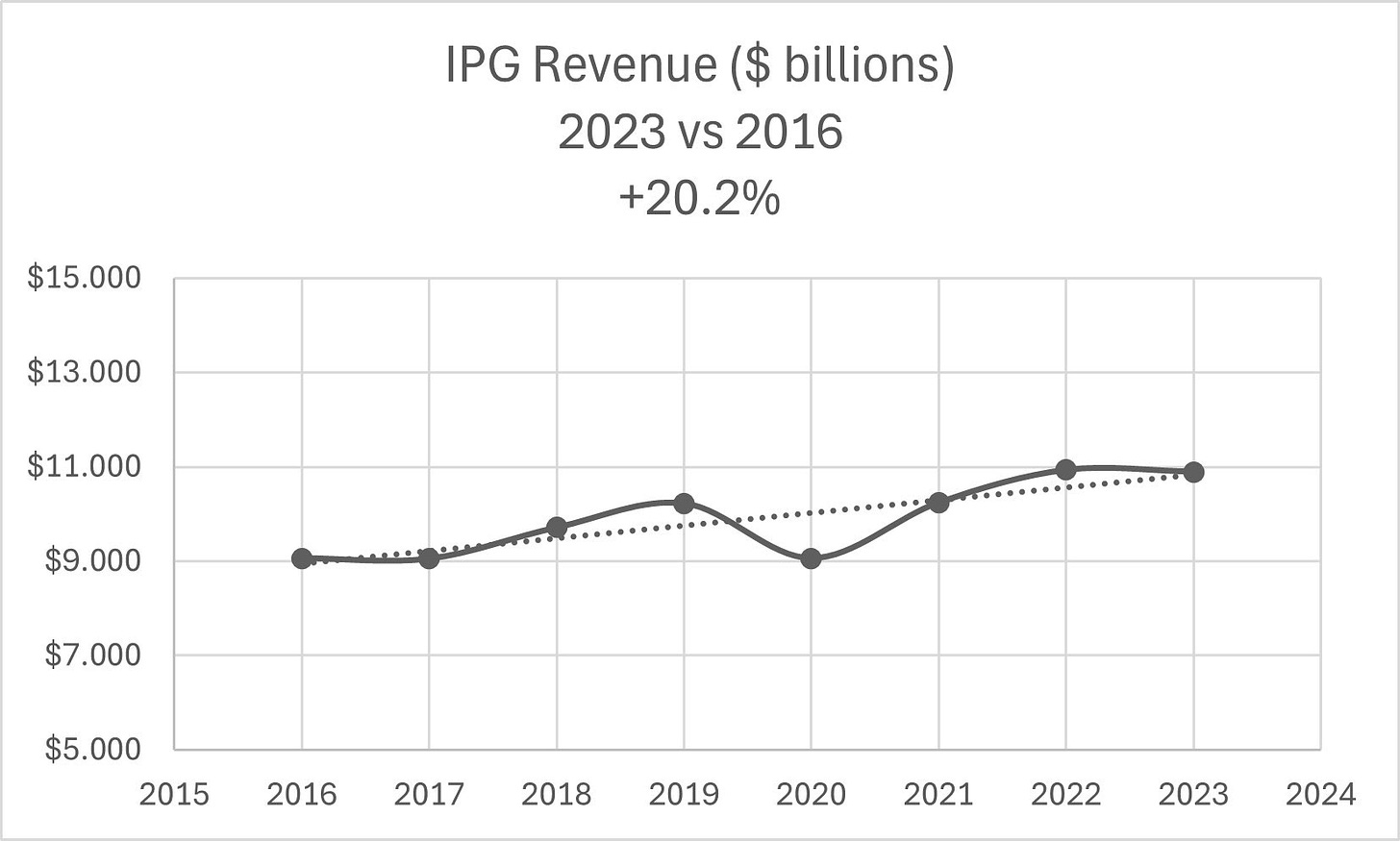

IPG acquired Acxiom in 2018 for $2.3 billion, and this data marketing company has strengthened IPG's data management and analytics capabilities.

IPG is, at the same time, a “business as usual” holding company, facing the usual challenges from bloated scopes of work and declining fees.

CEO Philippe Krakowsky recently announced that IPG is selling some operations (Huge and R/GA), increasing its principal media buying activities and thinking about “whether some legacy shops would perform better if they were under centralized leadership.”

(Author’s note: Legacy shops might perform better if centralized leadership develops an entirely new strategy to deal with growing scopes and declining fees, but if centralized leadership is simply a cost-reduction scheme, watch out!)

IPG’s employment headcount increased from 49,800 to 57,400 (+20.2%), and its sales increased from $9 billion to $10.9 billion (20.2%).

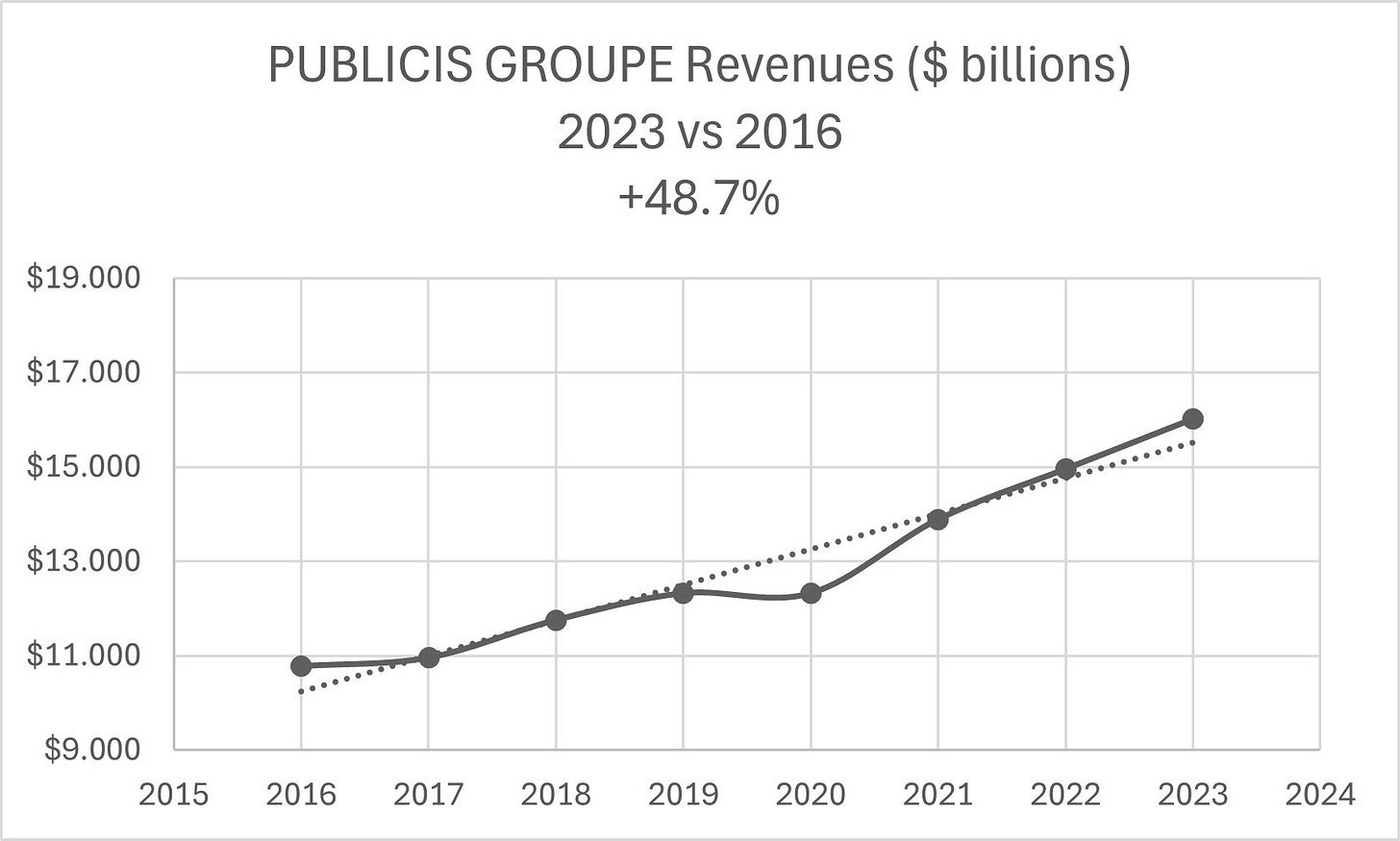

Publicis Group has astounded the industry through its strong growth under CEO Arthur Sadoun.

His “Power of One” strategy, which integrates Publicis’ capabilities, stands in contrast to the other holding companies, who rely more significantly on “business as usual."

Publicis’ 2015 acquisition of Sapient (digital consulting), the 2019 acquisition of Epsilon (data), and the 2022 acquisition of Profitero (analytics) have changed the character of the company. It is less a holding company than an integrated digital / communications operating company, and this is undoubtedly a key to its successful growth. Legacy creative brands, like Leo Burnett and Saatchi & Saatchi have been relegated to supporting, rather than to leading functions.

Publicis’ base media and creative businesses are probably doing no better on a day-to-day basis than those of the other holding companies. But the Power of One positioning has seen Publicis win more new clients than its competitors, and this has been a factor behind its exceptional growth.

Publicis grew its 2016-2023 employment headcount from 80,000 to 103,295 (+29.1%), and its sales from $10.8 billion to $16 billion (+48.7%).

Strong leadership and new directions are required for the holding companies.

“Business as usual” strategies no longer deliver growth, at least as long as agencies remain passive partners who accept bloated scopes of work at insufficient fees.

Scopes of work are seriously undermanaged. Creative agencies are “ad factories” that crank out thousands of deliverables — agencies need to know how much work they are cranking out. How else can they negotiate their fees? Unfortunately, scopes of work and fee-setting are seriously undermanaged, and too many client accounts are understaffed, compromising the quality of agency work.

Why else are agencies replaced at such frequent intervals?

It is too early to evaluate the effect of AI on holding company operations, although it is clear that AI will “steal” a significant number of man-hours and revenues unless remuneration schemes are changed to “pay for the work” rather than “pay for man-hours.”

WPP and Omnicom appear to be wedded to a “business as usual” strategy, hoping that their legacy businesses will “deliver the goods,” but it is not happening, given that they undermanage their scopes of work and fee-setting practices.

IPG is in a middle position — it has legacy businesses operating in a traditional way, and Axiom to provide new possibilities if it can be more fully integrated.

Full integration will require forceful leadership from IPG’s C-Suite.

Finally, we see Publicis enjoying the fruits of a committed, top-down, fully-integrated strategy.

Its French leadership and associated French culture give Publicis an advantage. Top-down direction is a characteristic of the French nation and the French culture.

“Le roi, c’est moi” defines the leadership requirement for holding company success — strong, committed C-Suite leaders led by the CEO.

Arthur Sadoun, to his credit, has provided Publicis with the kind of strong, transformational leadership that the industry requires.

Totally buy your numbers. But according to my math (and I'm a creative, so beware) publicis trails everyone in revenue per employee. More firings to come?

employees. rev(B). rev per employee

wpp. 114,000 18.5 162,280

omn 76,000 14.7 193,421

ipg 57,000 10.9 191,228

pub. 103,000 16 155,339