Omnicom / IPG Acquisition More Likely to Disrupt Themselves than the Advertising Industry...

...unless they use the disruption from the acquisition to transform themselves correctly -- something they did not do when they were on their own. Will they do all the right things now?

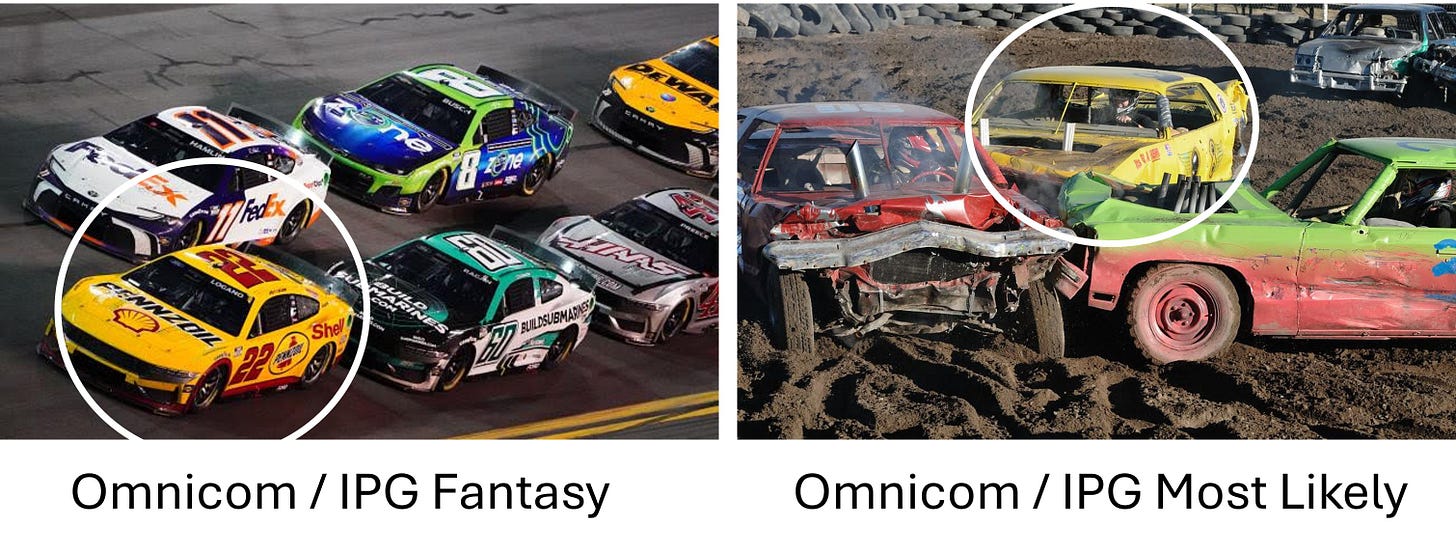

There is a big difference between NASCAR racing and Demolition Derbies. NASCAR requires speed, precision, and strategy over the destructive, last-car-standing approach of Demolition Derbies. Demolition Drivers who “graduate” to NASCAR need highly engineered cars, well-heeled investors and a new set of driving skills. Jimmy Spencer, Kenny Wallace and Clint Bowyer — all of them NASCAR winners — worked their way up from Demolition Derbies, deliberately transforming their driving approaches to deal with the sophistication of NASCAR racing.

Can Omnicom, in acquiring IPG, enter a new strategic phase? Can the new company graduate from Madison Avenue’s Demolition Derby of the past 20+ years — walking away from the price cutting and downsizings that have battered their agencies and turned them into subservient vendors, willing to do anything for an additional man-hour and buck?

Here’s the Problem

Proposed cost reductions. The proposed Plan A of the acquisition sees cost reductions on the order of $750 million. Nothing new about that. The fact that the two holding companies will continue cost reduction efforts that are exactly like what they have been doing on their own for the past 20 years does not change the game. It’s simply Demolition Derby on a grander scale.

The high level of cost reductions, $750 million, is designed to excite Wall Street investors and grow the share prices of Omnicom and IPG. Why? Because that’s the way that “increased shareholder value” will be measured and achieved. Furthermore, it is the way that C-Suite executives, like John Wren and Philippe Krakowsky will get even richer from the transaction, even if it means that 7,500 to 10,000 employees must lose their jobs for this to happen.

The 7,500 to 10,000 fired employees cannot all come from overhead savings, even if some of the agencies are merged (McCann with FCB? DDB with BBDO with TBWA?). Client Service, Strategic Planning and Creatives will surely provide much of the fodder for cost reductions. Does this make sense? Do Omnicom and IPG have “surplus” resources?

This is hardly the case. If anything, the opposite is true.

I estimate that 60% of Omnicom’s and IPG’s clients are already understaffed for their Scopes of Work (SOWs). Making further headcount reductions will only make their situations worse. Since neither Omnicom nor IPG document or measure the amount of work they do for their clients, they cannot know whether or not they have, or do not have surplus resources. These holding companies do not have surplus resources. Cost reductions will take muscle, rather than fat out of their operations. The magnitude of the cost reductions will kill morale and drive out the most talented people along with those who are fated to be culled.

A sensible person would conclude that the $750 million cost-reduction target was pulled out of thin air, designed to impress Wall Street rather than optimize Scope of Work staffing. It feels a bit like “this is the number we need; we’ll figure it out the details later.”

Integration of data / analytics with technology and creativity. Nothing new here. IPG has been struggling to integrate Acxiom since it acquired it for $2.3 billion in 2018, hoping to achieve something close to what Publicis Groupe would later achieve with its $4.4 billion acquisition of Epsilon in 2019.

Omnicom, for its part, did not make any data / analytics acquisitions until 2023, when it acquired Flywheel Digital for $835 million, so Omnicom is just beginning to learn how to integrate it with its other operations. Both companies are well behind Publicis Groupe’s highly effective, intensive top-down integration efforts.

Management style. As I pointed out in my 2023 book, Madison Avenue Makeover, both Omnicom and IPG have historically managed their agencies in a loose and informal way — except for the establishment of budget targets — leaving the management of their creative and media businesses to those in charge:

Of the big holding companies, two of them, WPP and Publicis, have taken holding company relationships so seriously that they’ve revised their corporate strategies, now positioning themselves as ‘single corporate entities’ rather than portfolios of individual companies.

At the other end of the holding company spectrum are Omnicom and IPG, describing themselves as holding companies with portfolios of strong, creative, independent businesses. Their strength, each says in its own words, comes from the strength and independence of their individual companies. In practice, the CEOs of these individual companies run their operations as they see best.

Omnicom and IPG stand in contrast to WPP and Publicis Groupe, focusing on the quality and independence of their individual agencies, rather than the efforts of the corporate entity to provide ‘center-led’ creative, media, and other services to clients.

The loose top management styles of Omnicom and IPG, similar as they are, do not bode well for the management requirements of the combined company. Yes, both holding companies know how to cut costs, but certainly more than cost-cutting will be required to restore health to their operations. Strong top-down leadership will be required to drive the other, more important changes.

Scale

Much has been written about the fact that Omnicom / IPG will become the largest of the traditional holding companies. This is a false narrative. Size does not really give them any great advantages, unless they intend on using their scale to buy media cheap and sell it dear to their clients — focusing more on principal media trading than on selling their media communications expertise.

Being the largest in an industry does not always confer scale. Scale exists in industries where being the largest means having the lowest costs in the industry to develop, produce and sell products.

The agency business, though, is a labor-intensive business with a variable-cost structure. There are very few areas in the cost structure that give scale. An agency with 100 uniform Scopes of Work requires 10-times as much labor as an agency with 10 uniform Scopes of Work. True, there are some modest scale economies for planners and buyers in media agencies, but these scale economies have been largely destroyed by the fragmentation of media channels.

If, though, Omnicom / IPG believe that they have scale after the acquisition (which they won’t), and if they seek to exploit this belief, then they will aggressively cut the price of their services when bidding against competitors, believing that they have a cost advantage — and further destroy their own economics.

Let’s hope that they do not go down this Demolition Derby route. Omnicom / IPG may become the largest, but it won’t have scale economics.

What should Omnicom / IPG do to succeed?

The industry has suffered from growing SOWs and declining fees. The industry has a price and income problem, not a cost problem. The failure to document, measure and charge for growing SOW workloads is the major management failure of the past 30 years — forcing agencies to downsize or liquidate their talent pool in order to deal with declining prices.

Omnicom / IPG could take advantage of their forthcoming disruption to ram through a change in policy: “At Omnicom / IPG, we will document and measure our SOWs in a uniform way for all our clients — and begin to charge for the workloads rather than for a guess at our man-hours.”

This is not a minor change. First, the “inventory” of existing media and creative work will have to be gathered, examined, classified in a uniform way, and analyzed. This will require the involvement of hundreds of client service executives around the globe, all of whom will need to be trained for the task. The media and creative deliverables will need to be classified in a uniform way and entered into a new SOW tracking system. Finally, agency executives will have to engage with their clients to propose a new transparent pricing system, based on “the work” rather than on man-hours.

The technology for this exists — ScopeMetrics® and ScopeTrack® were developed by Farmer & Company for this purpose — but thus far, there has not been enough courageous C-level leadership to push this policy through.

In Summary

There is no better time to implement change in an organization than when everything is up in the air. However, it takes a strong hand at the tiller to keep the ship upright when the winds of change are blowing.

Do John Wren and his C-Suite team have what it takes to do something other than “business as usual” at the combined Omnicom / IPG? Can they shift from Demolition Derby management to NASCAR sophistication? Can they see what is required beyond cost reduction to create long-term success for the Omnicom / IPG entity?

There is no evidence so far, either from current actions or public pronouncements — but Wren is known by his colleagues as a wily operator — a Madison Avenue version of Wile E. Coyote — so maybe he has some surprises yet in store for this acquisition.

Thus far, nothing is proposed for the merged company that Omnicom or IPG could have done for themselves.

Why? If they did not do the right thing for themselves when they were independent, why should we believe that they will do the right thing in the more complicated merged situation?

Cost reduction is the easier path, especially for companies that obsess over next-quarter results rather than the next 10 years. No surprise there, it's obviously the key driver behind the merge.

What you are suggesting (if I got that right) is that agencies go back to clients, asking for a raise because the effort is bigger than what they projected? Too bad adland is a buyer's market. Clients would simply scoff at the insanity and simply move to the next half-starved peddler of creative services. It's the same old story about "we should stop doing unpaid pitches".

Really, who will survive? Honestly, there will be a lot of thinning out. After that, players who have a digital fluency (doesn't mean they have to become it consulting replicants, that is also a business that will soon face issues) and, above all, the ability to create game-changing creative work, not generic pap that any in-house agency could produce. It's very hard, and it goes back to why the thinning out will happen.