Madison Avenue has a Price Problem -- Too Much Work for Meager Fees -- Rather than a Cost Problem Requiring Chronic Downsizings

So why are cost reductions the go-to strategies for holding companies, who must surely know better? Downsizings stress and liquidate talent; they do nothing to improve the quality of agency services.

Credit: Bruce Erik Kaplan, The New Yorker, The Cartoon Bank

Agency cost reductions made logical sense many years ago, at least up to 2004, when the staffing surpluses associated with the highly profitable media commission days were finally gone. What’s left are staffing shortages.

Let’s be clear about what “staffing surpluses” or “staffing shortages” are — these are staffing levels relative to the amounts of media or creative work to be done. You cannot evaluate staffing decisions unless you have a good idea about the amount of work in the Scopes of Work (SOWs) that agency staffs need to execute.

By 2004, all of the staffing surpluses were gone. Workloads and staffing levels were in balance. That was 20 years ago. For the past 20 years, agencies have been short of staff to handle their growing SOWs. Creatives, in particular, have had to significantly increase their outputs.

As recently as this week, Philippe Krakowsky, CEO of IPG, announced that in addition to the $750 million of cost savings that will be sought by the Omnicom acquisition, IPG had identified an additional $250 million of cost savings that IPG would implement in 2025.

Hmmm. One billion of costs to be eliminated. Amazing, isn’t it, that after 20 years of chronic cost reductions, a billion dollars has been found? Is it fat or muscle?

Ironically, after 2004, when the staffing surpluses disappeared, holding company headcount reductions continued annually even after digital and social innovations began to drive up agency workloads.

Omnicom’s headcount growth was only 1.1% per year during the 20 year period 2004 to 2024. IPG’s was only 1.4% per year. These rates are less than half the growth rates of media spend during this period. And workloads grew even faster than media spend.

Creatives are doing much more work today than at any point in Madison Avenue’s history. Granted, much of the work involves tiny deliverables, like ad banners, search, Facebook posts and adaptations of previously developed ads. But adaptations now make up as much of 40% of creative agency man-hours and revenues. Creatives, who (according to David Ogilvy) used to do only 3 ads per year, are now doing as many as 300 deliverables per year, or one per day.

This 20 year period has seen the loss of a great number of experienced agency executives, and even more dramatically, the loss of client longevity. Agencies used to remain with their clients for as long as 20, 30 or 40 years. Today, they get kicked out every 3-4 years. Why?

Advertisers have experienced a serious slowdown in their sales growth rates. Advertising quality has deteriorated. Nothing seems to be working very well in the industry — that’s why IPG has been out beating the bushes for an acquirer for the last year or so. Their “business as usual” routine of seeking to win new business (for growth) and downsizing (for margins) ran out of steam. Their business model no longer generates acceptable performance. An acquisition was IPG’s last hope to generate increased shareholder value for Wall Street.

**************************

Madison Avenue has a price problem, not a cost problem. The price of agency services has declined relentlessly for over 30 years. Workloads have grown; fees have declined. Mathematically, fees divided by workloads equals price.

We’ve tracked this since 1992, using ScopeMetric® Units (SMUs) as the measure of agency work in their SOWs. A typical TV spot has a ScopeMetric® Unit (SMU) value of about 1.0; an ad banner is about 1/135th the size of a TV spot, and so on. There are approximately 4,000 different types of deliverables, and each deliverable has a different and unique SMU value in our ScopeMetric® system. Add up the SMU values for each deliverable in a SOW and you have a measure of the amount of work in the SOW. Divide fees by SMUs and you have Price per SMU. It’s like “price per kilo” for a SOW, except that instead of kilos we use ScopeMetric® Units.

Price has declined from $435,000 per SMU in 1992 (when we began measuring SOWs) to about $110,000 per SMU today. These figures are in 2024 dollars; inflation has been removed.

By 2004, when the staffing surpluses had been eliminated, the price of creative agency services was $250,000 per SMU. It’s less than half of that level today.

Instead of liquidating agency talent, agencies and their holding company owners should have recognized that they needed to be paid for their work rather than for some guess at their man-hours.

And today, facing the ominous threat of AI to their man-hours and fees, agencies and their holding company owners must shift to deliverables-based pricing.

This, though, is not being done. Very few agencies either document or measure their SOW workloads in a uniform manner. Indeed, during our agency consulting assignments, we need to reconstruct client-by-client SOWs within an agency office so that we can get a handle on agency deliverables and pricing.

When this work is done, we always see a huge variance among the client-by-client prices being paid for SOW work.

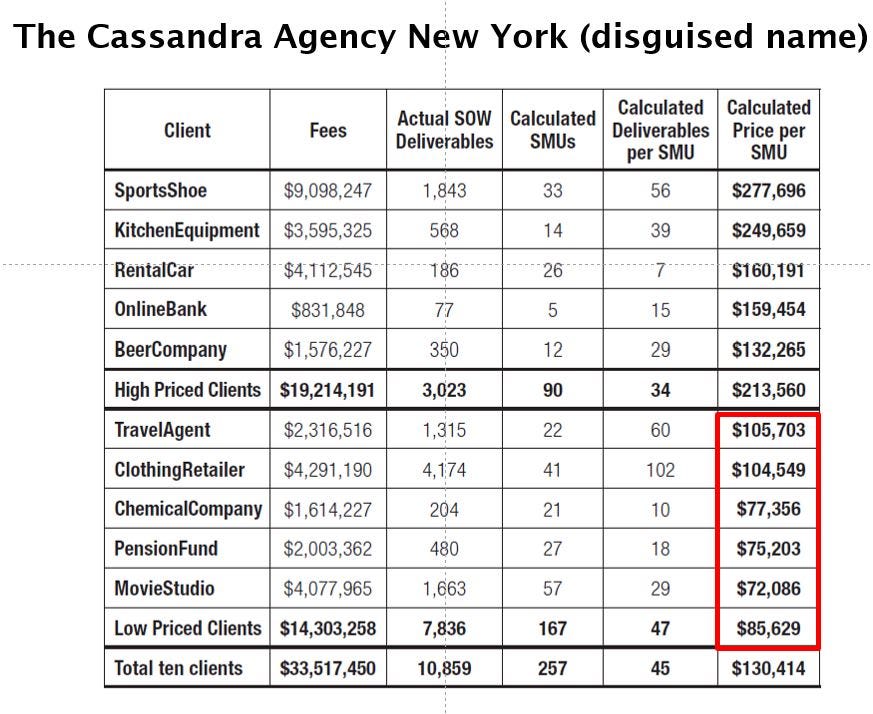

At “The Cassandra Agency,” below, five well-paying clients are more than offset by five poorly-paying clients whose Price per SMU varies from $105,703 per SMU to as low as $85,629 per SMU. Cassandra’s ten clients have ten radically different prices for their SOW work.

Source: Madison Avenue Manslaughter, 3rd Edition, referencing the SOW data from a disguised Farmer & Company client.

Evidently, there is little alignment between the size of the workloads and the fees charged by the agency. Since growing workloads are not a factor in the fees that are negotiated, it is small wonder that price varies all over the map.

Holding company and ad agency C-Suite executives need to be held to a higher standard than “pricing is random because we do not measure our work. Therefore we downsize and liquidate our talent pool….rather than change our business model.”

There is still time for Madison Avenue to shift its pricing from man-hour billing to deliverables-based pricing.

A renewed focus on SOW content and SOW pricing is called for today. ScopeMetrics® is available for those who wish to use it.

Who in Madison Avenue’s C-Suites is prepared to take up the challenge?

Excellent précis of an ever deepening issue Michael. A benchmark formula for a body of work is the way forward, too long agencies have been shooting from the hip in the first-place over fees or else get out-negotiated by the client. Adland is awash with poor pitchers and even less capable negotiators. Remember, anyone over 45 has been pushed out so they’re sending fresh-faced grads in to negotiate with battle-bruised titans of industry and these agency kids have no credible references to help justify the fees. ScopeMetrics sounds like a great tool to flip the conversation and give some spinal cord to the negotiation, nice.👌

Great article! Although there is a facing threat of Ai as indicated, I think there is a way to get your recommendation moving. It could start by using an Ai platform (non-bias) to begin assisting at solving the puzzle for the betterment of the client/agency partnership.